- Owe, owe owe? Here are 5 financial New Year’s resolutions for 2025.

- Exploring technology, innovation, and opportunity: Best of Financial Freestyle

- Personal finance lessons from Warren Buffett’s latest letter

- Pepe Memecoin Faces Market Shift After $4.54M Whale Dump

- Japan finance minister Kato – alarmed by FX moves, driven by speculators

Report Overview

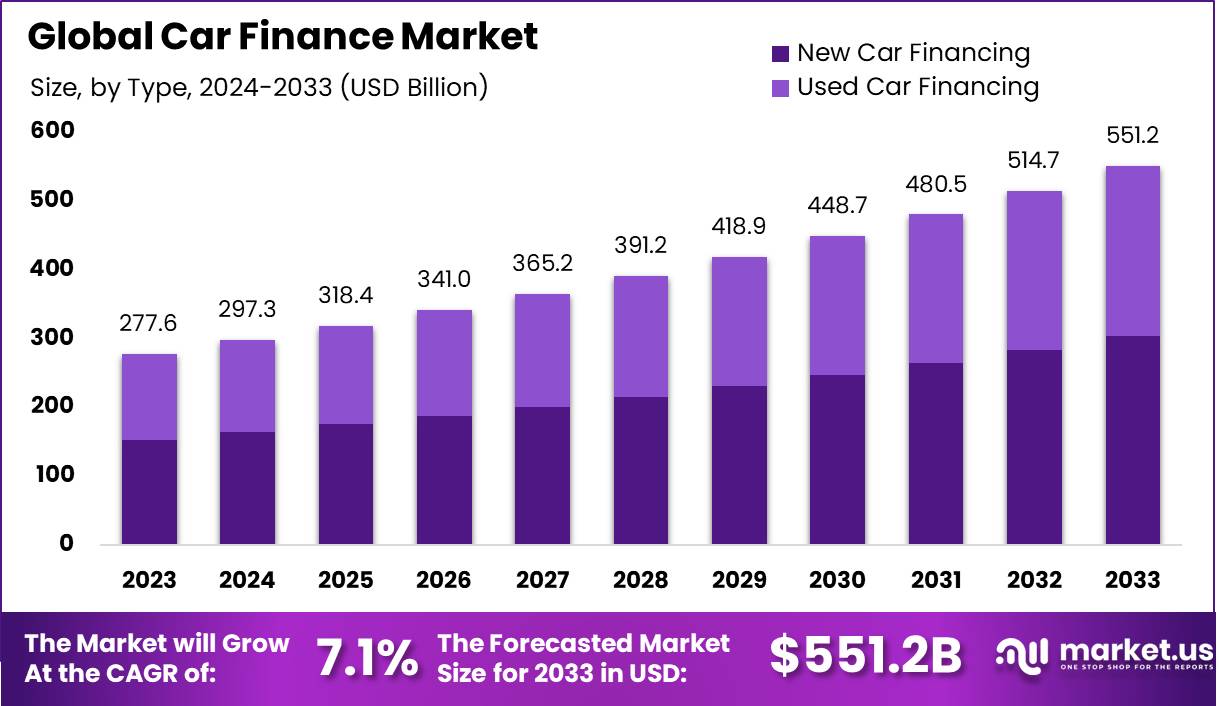

The Global Car Finance Market size is expected to be worth around USD 551.2 Billion by 2033, from USD 297.3 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35.8% share, holding USD 0.9 Billion revenue.

You are viewing: Car Finance Market Size, Share

Car finance encompasses a variety of financial products and services designed to assist consumers and businesses in acquiring vehicles. This market segment includes loans, leases, and other financing arrangements provided by banks, financial institutions, and vehicle manufacturers (OEMs).

The car finance market is influenced by several driving factors. Increasing vehicle ownership is a primary driver, with more consumers and businesses seeking financial solutions to facilitate vehicle acquisition. This demand is supported by flexible financing options such as loans and leases that cater to varying customer needs and financial circumstances.

Technological advancements, particularly in online and mobile platforms, also play a critical role in enhancing the accessibility and efficiency of car finance services, making it easier for consumers to apply for and manage their financing options online. Major driving factors in the car finance market include economic stability, consumer purchasing power, and interest rates.

![]()

Economic growth leads to higher disposable incomes, enabling more consumers to consider financing options for vehicle purchases. Conversely, low-interest rates make financing more affordable, reducing the total cost of owning a car. These factors are crucial in shaping the demand and accessibility of car finance options.

Market demand for car finance is primarily driven by the continual need for personal and commercial vehicles. Urbanization trends and an increasing preference for owning vehicles for convenience and safety contribute to sustained demand. Additionally, as new generations enter the workforce, their need for personal transport supports ongoing market growth.

According to Motor Finance Online, The automotive finance market continues to grow at an impressive pace, driven by consumer demand and innovative financing solutions. In 2023, the new vehicle segment dominated, holding over 86% of the market share. Projections suggest this segment will surpass US $489.3 billion by 2032. This growth reflects rising consumer confidence and an expanding array of financing options that make vehicle ownership more accessible.

Banks accounted for about 34% of the automotive finance market share in 2023. Offering diverse products such as loans, leases, and subscription services, banks are meeting a wide range of consumer needs. These flexible options have played a crucial role in driving vehicle sales by making large purchases more manageable.

The US automotive finance market emerged as a leader, commanding an 84% market share in 2023. It is expected to exceed US $179.6 billion by 2032. Factors such as economic improvements and rising consumer confidence have boosted vehicle sales. Financing solutions are enabling more Americans to afford new and used cars without the upfront financial strain.

Auto loans remain a substantial part of US consumer debt, with over $1.55 trillion in outstanding auto loan balances. This makes it one of the largest categories of consumer credit in the country. On average, Americans pay $716 per month for new car loans, reflecting the significant financial commitment involved in vehicle ownership.

Auto loan rates for new vehicles in the US vary widely, ranging from 4.75% to 13.42%, depending on factors like credit scores and financial profiles. These rates highlight the importance of creditworthiness in determining borrowing costs and overall affordability for consumers.

In Q2 2024, new vehicle loans saw a slight increase in the average amount, rising to $40,927 from $40,743 in Q2 2023. On the other hand, the average loan amount for used vehicles dropped to $26,248, compared to $27,316 the previous year. This indicates a shift in consumer financing preferences, with some leaning toward smaller loans or potentially more affordable options in the used car market.

Innovations in finance products, such as more flexible lease terms or subscription-based models, provide new ways to attract consumers. Furthermore, there’s a growing trend towards green vehicles, and financing options that specifically support the purchase of environmentally friendly cars could tap into a new consumer segment focused on sustainability.

Technological innovations are revolutionizing the car finance market. Digital platforms and services streamline the application and management processes for car loans and leases. For example, some financial services companies have introduced digital platforms that allow customers to apply for financing, manage their accounts, and access personalized services online.

Key Takeaways

- In 2023, the New Car Financing segment emerged as the leader, commanding over 55% of the global car finance market. This dominance reflects the increasing consumer preference for financing options tailored to new vehicle purchases, driven by growing affordability concerns and attractive financing schemes.

- The Banks & Financial Institutions sector also held a significant market share, contributing more than 48% to the market. Their extensive reach, credibility, and competitive interest rates continue to make them a preferred choice for car financing solutions.

- Among financing options, the Loan segment led the pack, representing an impressive 72%+ share of the market. This trend highlights the widespread reliance on structured loan offerings, which are designed to cater to diverse consumer needs.

- The Personal Use segment dominated in terms of application, accounting for over 81% of the market. This reflects the growing trend of individuals seeking private vehicle ownership, fueled by convenience and the desire for enhanced mobility in urban and suburban areas.

- From a regional perspective, North America maintained a stronghold in the global car finance market, with a market share exceeding 35.4%. This dominance is driven by the high purchasing power of consumers, advanced financial ecosystems, and the region’s robust automotive sector.

Emerging Trends and Key Highlights

- According to the Economic Times, demand for personal and vehicle loans, including those for two-wheelers and four-wheelers, has surged by 12% in the last four months. This uptick underscores the increasing affordability of vehicle financing and rising consumer confidence.

- Business Standards reported a rise in auto finance penetration for passenger vehicles (PVs), climbing from 72-75% in 2019 to 77-80% in 2023. This indicates greater accessibility and acceptance of vehicle financing solutions among consumers.

- As per an IDBI report, vehicle finance has become the second-largest segment in the NBFC asset under management (AUM), making up approximately 20-25% of the total AUM. This highlights the vital role of non-banking financial companies (NBFCs) in supporting the car finance ecosystem.

Type Analysis

In 2023, the New Car Financing segment held a dominant market position, capturing more than a 55% share of the Global Car Finance Market. This segment dominates the market due to the manufacturer’s strategic partnerships with financial institutions. These collaborations offer customers comprehensive financing packages with attractive incentives like customized loan options and comprehensive insurance products.

See more : 10 tips from experts to help you change your relationship with money in 2025

Consumer preferences significantly drive this segment’s growth, with buyers increasingly attracted to the latest vehicle models and advanced technological features. The ability to finance new vehicles with extended warranty coverage and minimal maintenance concerns makes new car loans more appealing as compared to used car financing.

Financial institutions are further supporting this trend by providing easier loan approval processes and competitive interest rates for new vehicles. The expanding global automotive market with the rising disposable incomes and the need for personal mobility, continues to propel the new car financing segment’s market position.

Loan Provider Analysis

In 2023, the Banks & Financial Institutions segment held a dominant market position, capturing more than a 48% share of the Global Car Finance Market. This is due to their robust financial infrastructure and established customer trust. Their ability to offer comprehensive financing solutions with minimal documentation and faster processing makes them attractive to potential vehicle buyers.

The competitive edge of banks is due to their flexibility in loan offerings, including 100% vehicle financing and extended repayment options. Digital transformation has further enhanced their market position, with innovative online platforms and mobile-based services making car loans more accessible and convenient for consumers.

Financial institutions leverage their extensive networks, strong credit assessment mechanisms, and brand loyalty to maintain market leadership. By continuously adapting to changing consumer needs and technological advancements, banks and financial institutions have successfully positioned themselves as primary car finance providers, offering tailored solutions that cater to diverse customer segments.

Purpose Analysis

In 2023, the Loan segment held a dominant market position, capturing more than a 72% share of the Global Car Finance Market. This is due to its customer-friendly approach, offering credit services that enable vehicle purchases with flexible repayment options. Loans provide customers the opportunity to become legal vehicle owners, with the added advantage of potential future resale.

Banks and financial institutions have streamlined loan processes, making vehicle financing more accessible. The emergence of online platforms and mobile applications has further simplified loan applications, allowing customers to compare and apply for financing with unprecedented ease and convenience.

Consumer preferences increasingly favor loans over leasing, primarily because loans offer ownership and long-term financial flexibility. The rising vehicle prices and innovative financing options appreciate the ability to customize repayment terms and build potential asset value.

![]()

![]()

End User Analysis

In 2023, the Personal Use segment held a dominant market position, capturing more than an 81% share of the Global Car Finance Market. Personal vehicle financing dominates the car finance market due to individuals’ growing aspirations for mobility and social progression.

The segment reflects consumer’s desire for personal transportation as a symbol of economic advancement and individual freedom. The rising disposable income and increased accessibility of automotive loans have significantly contributed to personal vehicle segment growth.

For instance, according to the Economic times, Per capita disposable income grew 8% in FY24 and 13.3% in the previous year and gross national disposable income is expected to expand 8.9% in FY24. Consumers are increasingly comfortable with longer-term financing options, demonstrating confidence in future economic stability and personal earning potential.

Technological innovations in financing platforms, coupled with easier loan approval processes, have further accelerated personal vehicle financing. Banks and financial institutions are offering competitive interest rates and flexible loan terms, making car ownership more attainable for a broader range of consumers across urban and rural markets.

Key Market Segments

By Type

- New Car Financing

- Used Car Financing

By Loan Provider

- Banks & Financial Institutions

- OEM Captive Finance

- Credit Unions

By Purpose

By End-User

- Personal Use

- Commercial Use

Drivers

Increased vehicle ownership is driven by urbanization

Urbanization is propelling vehicle ownership by transforming mobility perspectives and economic landscapes. This has in-turn catalysed the car finance market across different urban areas. As cities expand, individuals increasingly view personal vehicles as essential assets for navigating complex urban environments and maintaining professional mobility.

For instance, according to World Bank, 56% of the world’s population – 4.4 billion inhabitants – live in cities. This trend is expected to continue, with the urban population more than doubling its current size by 2050, at which point nearly 7 of 10 people will live in cities. This has led to an increasing demand for car or vehicle loans from banks and financial institutions.

The rising urban middle class is driving the car finance market growth through increased purchasing power and aspirational lifestyle choices. Emerging urban population perceives vehicle ownership as a symbol of social progression, creating robust demand for accessible financing options that enable automobile acquisition.

Restraint

Economic Fluctuations Impacting Consumer Purchasing Power

Economic fluctuations significantly impact consumer purchasing power, creating substantial challenges for the car finance market. Inflation and interest rate volatility directly influence consumer’s ability to secure and manage automotive loans, reducing their financial flexibility.

According to the International Monetary Funds, the world economy continues growing at 3.2% during 2024 and 2025, at the same pace as in 2023. Rising interest rates increase monthly loan payments, deterring potential buyers and extending vehicle ownership cycles. Consumers become more cautious about major financial commitments leading to decreased demand for new vehicle financing and a more conservative approach to automotive purchases.

Opportunities

Digital transformation in financing processes

See more : Biz2X Announces 2025 Frontiers of Digital Finance (FDF)

Digital transformation is revolutionizing car finance by enabling seamless, customer-centric lending experiences. Advanced technologies like AI, blockchain, and data analytics are reshaping traditional financing models, offering unprecedented personalization and efficiency.

Emerging digital platforms are creating innovative opportunities for auto financiers. According to the Word Bank, about one-third of the global population, or 2.6 billion people, remained offline in 2023. While more than 90% of people in high-income countries used the internet in 2022, only one in four in low-income countries used the internet. 850 million people lack any form of identification.

Embedded finance solutions allow end-to-end vehicle purchasing experiences integrating search, financing, and transaction processes within a single interface. These technological advancements significantly reduce loan approval times and enhance overall customer satisfaction.

Challenges

Adapting to rapidly changing consumer preferences

Consumer preferences in automotive financing are rapidly evolving, driven by technological advancements and changing lifestyle dynamics. Digital platforms and seamless online experiences have become critical expectations for modern borrowers seeking convenient financing solutions.

The emergence of electric vehicles and sustainable transportation options is reshaping traditional financing models. Consumers tend to demand flexible, personalized loan structures that accommodate emerging mobility trends, pushing financial institutions to redesign their traditional lending approaches and develop more adaptive credit assessment mechanisms.

Growth Factors

Consumer demand and increasing vehicle prices are driving significant growth in the car finance market. Rising disposable incomes and urbanization have created a robust environment for automotive financing, enabling more individuals to access vehicle ownership through flexible loan options.

Technological advancements are transforming the financing landscape, with digital platforms offering streamlined loan applications and swift credit decisions. The emergence of innovative financial products, including online lending models, and cryptocurrency-based payment solutions, is expanding market opportunities and enhancing consumer accessibility.

Latest Trends

Digital transformation is revolutionizing car finance, with AI-powered platforms, enabling personalized lending experiences and streamlined loan approvals. Financial institutions are increasingly adopting advanced technologies to enhance customer interactions and credit assessment processes.

The rise of electric vehicles and alternative mobility models is reshaping financial vehicles and alternative mobile models are reshaping financial strategies. Innovative financing packaging now accommodates emerging consumer preferences, including flexible leasing options, subscription models, and tailored solutions for sustainable transportation technologies.

Regional Analysis

In 2023, North America held a dominant position in the car finance market, capturing more than a 35.8% share with revenue amounting to approximately USD 0.9 billion. This strong market presence can be attributed to several key factors.

Firstly, North America benefits from a robust economic environment and a well-established automotive industry, which facilitates higher consumer spending and access to car financing options. The region’s market is further bolstered by the presence of major financial institutions and automotive finance companies that offer a wide range of financing solutions tailored to diverse consumer needs.

The proliferation of digital solutions in the car finance sector has also significantly contributed to North America’s leading position. Financial service providers in the region have embraced digital platforms that enhance customer engagement and streamline the financing process. This digital transformation has not only improved the efficiency of services but also expanded access to car finance for a broader demographic.

Furthermore, the market in North America is driven by favorable regulatory frameworks that support both consumers and lenders. These regulations ensure a stable financing environment, which builds consumer confidence and encourages more people to avail themselves of car finance options. Additionally, the high rate of vehicle ownership and the cultural prominence of cars in North American society continually fuel demand for automotive finance services.

![]()

![]()

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in the market is Toyota Financial Services, which provides comprehensive financial services including auto loans, leases, insurance, and protection products. Another prominent firm operating in the market is Ford Credit, which provides finance for Ford and Lincoln vehicles. It delivers services such as consumer auto loans, dealership inventory financing, and leasing options.

Toyota Financial Services (TFS) has demonstrated a strategic commitment to leadership and innovation in the automotive finance market. In December 2023, Scott Cooke was promoted to President and CEO of TFS, reflecting the company’s focus on continuity and experience in its leadership. Cooke’s history with Toyota, spanning over two decades in roles across treasury, business intelligence, and finance, underscores his deep understanding of the company’s operational and strategic goals.

Ford Credit, the financial services arm of Ford Motor Company, is known for its robust portfolio of financial products tailored to both individual consumers and dealers. The company focuses on leveraging technology to enhance customer experiences and operational efficiency. Recent years have seen Ford Credit introduce digital tools that streamline the financing process, making it faster and more accessible for customer.

Volkswagen Financial Services is actively expanding its global footprint and refining its services to support the Volkswagen Group’s sales. The company’s strategy often involves tailoring financial products to specific market needs, facilitating easier access to vehicle financing, and promoting electric vehicle adoption through attractive financing options

Top Key Players in the Market

- Toyota Financial Services

- Ford Credit

- Volkswagen Financial Services

- GM Financial

- Santander Consumer USA

- Ally Financial

- Bank of America

- Capital One Auto Finance

- BNP Paribas

- Daimler Financial Services

- Other Key Players

Recent Developments

- In April 2024, the auto finance arm of China’s state-owned automaker FAW Group launched a loan program with no down payment, becoming one of the first providers to make such a move since the removal of government-set minimum payments.

- In April 2024, Odessa, an equipment finance company entered the auto industry. The company has launched an originations platform called Odessa Auto and plans to grow it into a full-service end-to-end auto finance suite.

- In October 2023, Bajaj Finance Ltd, launched its microfinance businesses which finances tractors and commercial vehicle lending.

- In March 2023, Mahindra and Mahindra Financial Services has launched a specialized end to end digital journey named ‘Used Car Digi Loans’ in association with Car&Bike (by Mahindra First Choice Wheels) and Rupyy (by Cardekho).

Report Scope

Source link https://market.us/report/global-car-finance-market/

Source: https://summacumlaude.site

Category: News