- Best low- and no-down-payment mortgage lenders of January 2025

- Stocks in Translation guests suggest investors pay attention to these areas in 2025

- Oberlin Introduces Financial Economics Major to Meet Growing Student Interest

- The Fed is sounding more hawkish. Those voices may get louder in 2025.

- The ‘exciting’ part of Robinhood’s growth is still ahead: Analyst

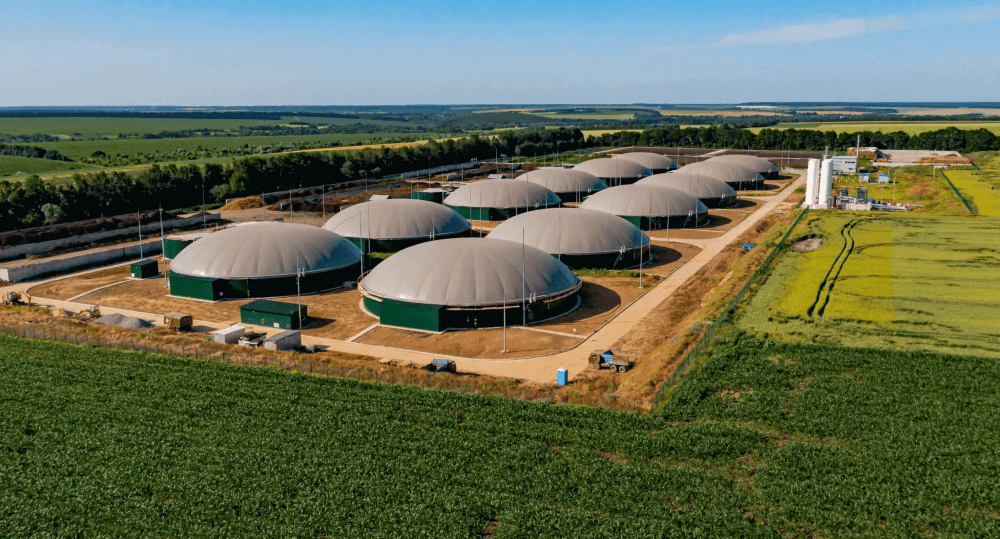

After two decades of providing flexible, patient capital to infrastructure projects in Africa, the Emerging Africa Infrastructure Fund saw opportunities to apply its expertise to developing markets in Asia, which, like Africa, are fast-urbanizing and vulnerable to climate change and natural disaster. Last October, the fund — now called Emerging Africa and Asia Infrastructure Fund, or EAAIF expanded its mission last year to include Asia.

You are viewing: EAAIF is using its African expertise to finance infrastructure in Asia

Asia’s developing markets are also less saturated by investors and have opportunities for sustainable growth and impact, much like Africa, where small to medium-sized businesses have a critical role in economic growth, Esther Chan, investment director at Ninety One, which manages EAAIF, tells ImpactAlpha.

“In Asia you would find that it’s a lot more banked and there’s a lot more financing chasing the same opportunities, but they’re all in senior, secured financing and not actually in the more subordinated or more difficult, small to mid-sized companies which are actually doing the important work in (energy) transitioning in the country,” she says.

The fund, a subsidiary of UK’s infrastructure financier Private Infrastructure Development Group, uses a blended finance approach to raise capital and has been providing long-term debt for private infrastructure projects in Africa and now Asia spanning renewable energy, social infrastructure, transportation and digital communications projects.

EAAIF raised $294 million in debt in January last year, well over half of its $500 million fundraising target for 2025, and is looking to deploy over a billion over the next four years in both Africa and Asia. It has already financed a sustainable aviation fuel facility in Pakistan and an industrial solar portfolio project in Vietnam and has a social infrastructure project in its pipeline.

Drawing from Africa

See more : Wilkes-Barre finances looking good as year comes to a close – Wilkes-Barre Citizens’ Voice

The fund is drawing on learnings from its two decades in Africa to replicate its impact in Asia. One lesson: investing in portfolios of projects helps scale impact, says Chan.

In late 2023, for example, EAAIF offered a $30 million loan to Axian Energy, a large-scale developer of renewable energy projects, to set up greenfield utility-scale solar projects in Senegal, Madagascar, Mozambique, and Sao Tome & Principe, among other countries. The aim was to support a portfolio of projects instead of focusing on individual projects, a strategy EAAIF hopes to employ in Asia.

“They (Axian Energy) have an objective of building up a renewables portfolio in Africa, and so that’s a learning that we’re taking in Asia, which is willing to then look a level up,” she says.

The fund has already taken this approach with its second Asia investment, a $20 million loan to CME Solar, a Vietnamese commercial and industrial solar solutions provider, to support a pipeline of rooftop solar projects in the country.

Catalytic capital

The CME Solar investment was intended to mobilize more funding by helping the solar company tap into larger pools of capital. EAAIF expects the loan to be leveraged to increase CME Solar’s equity in different projects, which can be used to land additional financing.

“They are going to use this to inject equity so that they can raise senior secure debt financing at the “OpCo” (operating company) level,” Chan says.

“I think you’re going to see some interesting structures coming through, stepping into a space where larger commercial banks — even the large ones in Japan that are investing in Asia — are not willing to,” she adds. Such banks, she said, are more comfortable with familiar utility-scale projects. “They find rooftop solar very hard to do because there’s multiple portfolios of different projects to look at.”

Legal landscapes

See more : Ahead of Trump presidency, U.S. banks abandon Mark Carney climate initiative

One area of difference: credit risk in Africa and Asia. According to Chan, African companies and governments are often very open to input from investors.

“They’re willing to help us mitigate some of the risks through legal contracts, so contractual rights are stronger actually in Africa from a regulation point of view,” she says. That includes legal contracts that hold termination rights that can be used to shield investors from risks.“There are a lot of contracts which mitigate risks with dollar annexation, which means that even in power projects or renewable projects, a lot of power purchase agreements are in dollars.”

In Asia, however, termination rights are weaker. Local currencies also dominate most of the contracts, which can lead to currency mismatches that need to be mitigated and overall mean lesser protection for investors.

“I think the actual perception is that credit risk is lower in Asia, but once you get a default, the creditors’ rights are all weaker compared to Africa,” says Chan. The fund is currently conducting an overview of the legal landscape for creditors in Sri Lanka, Nepal, the Philippines and India.

Environmental and social issues

Cost sensitivity around ESG considerations is another challenge. While EAAIF generally sees more willingness to adopt ESG standards amongst Asian companies — even small ones — it doesn’t come without pushback around the associated costs.

“It’s a lot harder to convince companies in Asia to spend the money on making changes. They want to do it, but there’s a lot of pushback on managing the costs,” Naasir Roomanay, an ESG and sustainability investment specialist at Ninety One, tells ImpactAlpha. In contrast, “in Africa, it’s almost accepted that we need to spend money.”

“There’s certain ways to get around it,” such as baking the cost into the financing or setting longer term goals instead of imposing costs up front. “You can phase in some of the changes and sort of support the company. The general message is to do what works for the business,” he says.

Source link https://impactalpha.com/how-eaaif-is-leveraging-its-african-expertise-to-drive-infrastructure-financing-in-asia/

Source: https://summacumlaude.site

Category: News