- BioNTech to pay $791.5M in settlement agreement with the NIH

- Why Bill Ackman is ‘confident’ Trump will privatize Fannie Mae and Freddie Mac

- UK Authorities to Improve Cooperation on Payments Vision

- ‘The joke is over’: Canadian finance minister says Trump’s ’51st US state’ remarks no longer funny

- From Classroom to Boardroom: Plutus Education’s Success in Shaping Finance Leaders

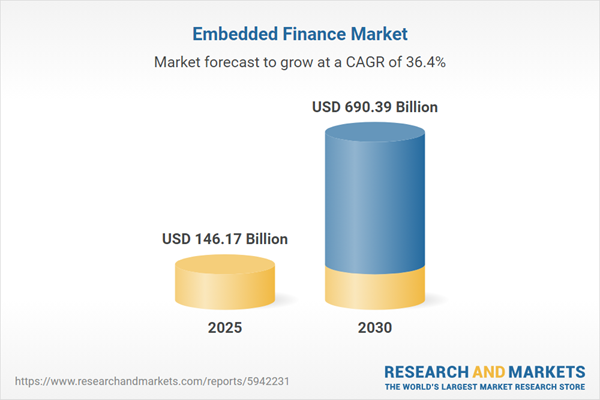

Embedded Finance Market

You are viewing: Growing Demand for Digital and Convenient Financial Services to Fuel Adoption and Growth

Dublin, Jan. 13, 2025 (GLOBE NEWSWIRE) — The “Embedded Finance Market – Forecasts from 2025 to 2030” report has been added to ResearchAndMarkets.com’s offering.

The embedded finance market is expected to grow at a compound annual growth rate (CAGR) of 36.41% from US$146.171 billion in 2025 to US$690.386 billion in 2030.

The market growth is mainly attributed to the increasing popularity of online payment services, i.e., the growing demand for digital and convenient financial services is anticipated to drive the overall market growth. Furthermore, technological advancement, which provides seamless integration between non-financial and financial platforms, is making businesses secure to incorporate payment more conveniently.

The rising willingness of consumers to utilize integrated financial services and the rising adoption of financial services online platforms like e-commerce websites and safe online payments are also resulting in the embedded finance market growth in the future. For instance, in April 2024, Finzly launched Account Galaxy, a groundbreaking solution that empowers banks of all sizes to participate in the emerging embedded banking segment, overcoming limited participation due to the advanced technologies required.

In March 2023, SAP Fioneer launched its first B2B embedded finance platform, “Fioneer Embedded Finance as a Service,” which allowed Financial Service Institutions (FSIs) to connect to SAP Enterprise resource planning processes, enabling the development of innovative embedded finance solutions.

Embedded finance market drivers

The growing digitalization of business is projected to propel the embedded finance market expansion.

One of the prime reasons supporting the market growth is the growing inclination of businesses towards digitalization and the rising popularity of embedded finance services in every sector. Consumers around the globe are switching toward e-commerce, which is expected to augment the market growth during the forecast period. Moreover, as per the US Census Bureau of the Department of Commerce data of e-commerce, retail sales revenue in the U.S. increased from US$271.86 billion in the first quarter of 2023 to US$285.22 billion in the fourth quarter of 2023. Additionally, In Q4 2023, e-commerce sales accounted for 15.6% of total sales.

Moreover, increasing digitalization has given acceptance to various services like consumer lending and UPI payments and MasterCard payment acceptance has also seen a massive rise in the business sectors. For instance, in January 2024, Cybrid, a provider of embedded finance API solutions, expanded its platform to include B2B payment capabilities.

Embedded finance market geographical outlook

The embedded finance market in India is affected by various factors, such as the growth of extensive mobile and internet connectivity in the country coupled with a robust tech ecosystem. For instance- as per Internet in India Report 2023, the active internet users in the country have crossed the 800 million mark.

Source link https://finance.yahoo.com/news/embedded-finance-market-forecasts-report-160700878.html

Source: https://summacumlaude.site

Category: News