- Climate Finance Roadmaps – CPI

- How many people are financially secure in Harris County?

- Smotrich, Ben-Gvir clash over Yamam pay raise amid broader budget feud

- Fulton Financial’s (NASDAQ:FULT) Dividend Will Be Increased To $0.18

- Carbon Revolution Secures $27M Strategic Financing Deal to Fuel Production Expansion

Wia dis foto come from, Reuters

You are viewing: Financial discipline: Psychological blocks wey dey lead us to make bad financial decisions and how to overcome dem?

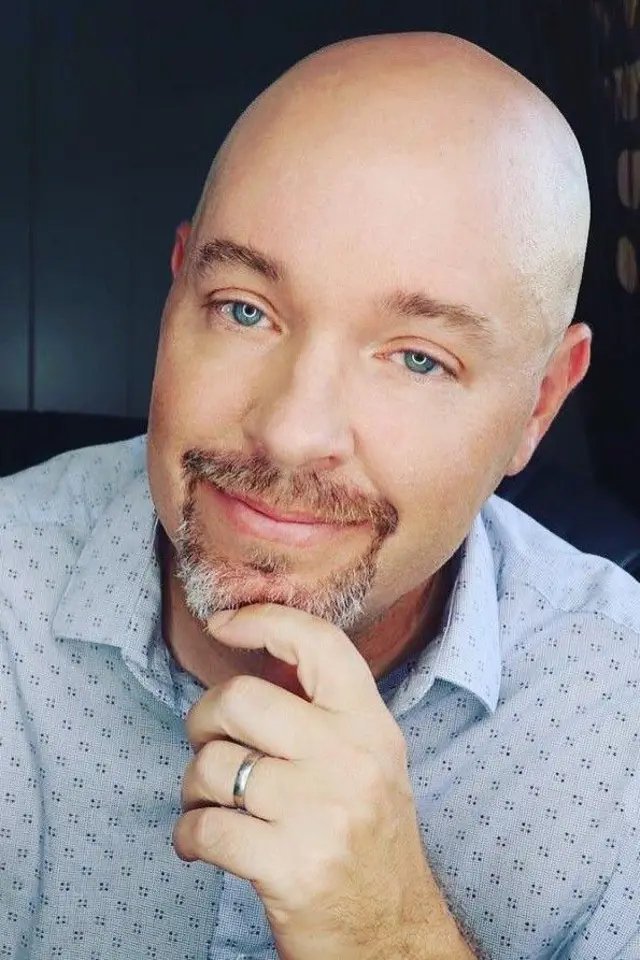

- Author, Cecilia Barría

- Role, BBC News Mundo

Bradley Klontz , na American psychologist and financial advisor, wey don co-author and co-edit eight books on relationship between money and di mind.

Im ‘financial therapy’ approach dey try explain di psychological factors wey dey lead us to make decisions wey di impact fit reach many years.

Associate professor for Creighton University Heider School of Business for di US and co-founder of di institute for Financial Psychology, Klontz argue say our beliefs about money sometimes dey rooted for di lived experiences of our ancestors.

Na dis beliefs dey form wetin e describe as ‘money scripts’, wey be basically tory or narratives wey our brains make up to explain di world wey we live in and di way we relate to money.

On im journey, e bin discover how im own idea say make e work more dan 70 hours per week so e no go feel like slacker compared to im father, bin actually come from beliefs wey im grandfather get, wey in turn, don react against im great-grandfather attitude.

Dis intergenerational patterns allow am to better understand im own life and di poor financial decisions wey e bin make wen e bin young.

For im research e bin discover say e get four mental scripts about money wey wen dey become toxic, fit dey highly destructive.

Inside dis interview wit BBC Mundo e tell im personal tori and give clues on how to change those mental blocks wy dey work against us.

Why we dey make bad decisions wit our money?

Most of di psychological problems wey we dey get wit money need do wit di fact say we dey save for di future or say we dey spend more dan we get.

And dat one dey explained by di way our brain connections dey work.

If you look human evolution, for di beginning we bin dey grouped in small hunter-gatherer tribes of about 100 or 150 pipo. Wetin dey need do to survive and develop dat kind environment explain all di problems wey we get wit moni.

Make we see, if you give me one example of one problem wey you don get wit money?

Make I think… I think I dey avoid debt. I dey get anxious about not being able to pay dem.

Dat na one example of money script, wey be, belief say you fit don inherit from your ancestors.

At some point maybe your mama or grandmother go through one experience wey bin teach dem say to dey in debt na really bad tin. And e fit don happun to dem or to pesin wey dem sabi.

So your mental script tell you say all debt bad. Now, e dey always get some element of truth inside those scripts wey we all get. Di problem dey rise wen you take am to very extreme version.

No be all debt dey bad, but your script tell you say e bad. Di idea na to find out where dat tori dey come from, sake of say e dey always get intense emotions wey attach to dat belief. And di more emotion dey attached to dat belief, di harder e dey to change am.

Wia dis foto come from, Bradley Klontz

E go dey difficult to change di script in di sense say e no dey rational.

Ways to rewrite di scripts, to modify di beliefs wey we get about money. You fit replace di script ‘all debts dey bad’ wit ‘some debts dey bad’, by writing dis sentence on one piece of paper, read am and repeat am several times.

But di first tin to sabi na wia dis belief dey come from.

Make we tok about dis idea say beliefs about money dey passed on from one generation to di next.

Wetin be your experience?

My grandfather lost everytin be di Great Depression (1929). Im script na say you no fit ever trust banks and for di rest of im life e never put one dollar in dem again, sake of say e dey traumatised afta dat experience.

How you take realise wetin happun to your grandfather influence your life?

I dey tok to my father, wen e dey work probably about 100 hours one week. E bin tell me say despite say e dey work long hours, e feel lazy compared to im father.

At dat point my wife bin tell me, ‘Oh, you do dat,’ sake of say I don work for 70 hours dat week and I feel like slacker compared to my father.

Wen I bin understand wetin dey go on, I. bin think dey crazy. I don live my whole life wit dis feeling of guilt say Inever do enough. Na like wake-up call.

Den I find out say my great-grandfather na slacker. Den my grandfather bin work very hard dey try to impress im mama.

I realise say i dey make mistake,say i dey feel anxious, and say if I keep working like dat, I no go dey present for my children lives. I bin ask myself: If I dey do sake of say my great-grandfather na slacker?

Wia dis foto come from, Getty Images

You dey manage to get rid of dat feeling of guilt sake of say you dey work long hours?

I become aware, I den decide say I no go continue to work so much, but e no dey easy to let go of di feeling of guilt.

I bin start to change di script by saying to myself: ‘I don work hard today, na five o’clock in di afternoon, I dey go home, and I dey go to be wit my wife and children sake of say e dey important to me’.

I need to write dat new script, read am, say am out loud and repeat am. I do am for several months until e get to di point wia I no get to do am anymore.

And if dat feeling of guilt come back, I tell myself: ‘I dey go to be wit my children, dis feeling of guilt no be mine, e dey come from oda generations and I no dey go to repeat di pattern’.

How common e dey for dis money scripts to dey passed down from generation to generation?

We all get scripts, some dey positive, some dey negative, but we all get dem.

Wia dis foto come from, Getty Images

I dey think say just as we get certain mental blocks for individual level, we also get collective mental patterns.

Yes, disturb about money dey universal. E dey comes from wen we be hunter-gatherer society. Dat explain bad investment decisions, or saving less dan you fit save.

Experiences wit money wey get cultural impact. I remember say i dey work wit one couple, she be American and e be Venezuelan. Whenever e get money wey e spend am immediately sake of saye go through one hyperinflationary experience for im kontri and learn from one young age say e dey better to buy tins instead of saving money sake of say for any moment di notes fit dey worthless.

In oda cases, if you grow up for poor family, you fit get di belief say you go ever get enough money. Wey mental script fit dey completely true, but di problem b e say wen e become self-destructive and even if di context change, you no dey prepared to change di script in new circumstances.

Wetin be your personal history wit money like?

I bin grow up for low-income family. My parents divorce when I be 2 years old.

E bin dey difficult for you?

Yes, I remember when I dey little, di TV in my house bin break and my mother bin cry sake of say she no get money to fix am. She bin go down on her knees to pray.

In fact, my grandparents on both sides of my family bin dey live in trailers (mobile homes wey dem arrange to live permanently).

Wit my mama, I quickly learn say to dey poor na very bad tin. She bin rent out di basement of di house for oda pipo to live in so we go fit pay di mortgage.

I need to borrow money to go to university and I bin finish my studies wit US$100,000 in debt. I remember say my script na “debt is bad’, but I need to go into debt in order to get degree.

Wetin be your personal history wit money like?

I bin grow up for one low-income family. My parents bin divorce wen I be 2 years old.

Wia dis foto come from, Getty Images

Personally, did you make mistakes wit money management?

Yes, di first tin I do when I bin get job na to buy one watch wey cost US$2,000 and I bin buy my mother one very expensive bracelet. I bin wan show her say I don make am

I bin fall into dat trap,dey think say rich pipo spend money dat way, but di truthbe say millionaires wey don build dia own wealth describe demselves as thrifty pipo.

See more : Financial Goals | News, Sports, Jobs

Di oda mistake I make na say i bin see oneI friend wey make US$100,000 in one year buying and selling stocks, and I think say e dey easy.

So I sell everything I get of value, di car, even di furniture, and put di money in di stock market. I do very well for few months, until di tech bubble burst and I see all my money vanish.

Yes, and di question I ask myself na: why intelligent person dey do something so stupid wit im money?

I bin look into am from one psychological perspective and find no research. So I start my own studies to try to understand why I make those mistakes and how our relationship wit moni dey work.

I don study di mentality and habits of ultra-rich pipo to teach myself.

Wetin be your relationship wit money like today? How you manage to change di beliefs you get about money?

I do am by setting goals to improve my socio-economic situation and den find pipo wey belong to dat tribe where I wan to be. I bin ask myself, wetin dem dey think, wetin dem dey do, wetin dem dey do? And dat na my journey since I be11 years old.

When I set one goal, I look for pipo don achieve and try to learn from dem.

Wia dis foto come from, Getty Images

You argue say na four financial scripts, four mental patterns dey repeated in society, wetin dem dey about?

I discover dis scripts in my research. We bin interview thousands of pipo and discover patterns wey dey repeated in di answers.

Di first financial script na to avoid money (spend di minimum). Dis script tell us say pipo dey stingy, say money dey corrupt,say e dey virtue to get less money.

E dey often associate wit terrible financial experiences, wit low-income situation or wit financial self-destructive behaviour.

If we trace di origin of dat pattern, we dey likely to find say family history say e get some evil rich pesin, but no be all rich pipo like dat, so e become dysfunctional script.

Anoda script na di exact opposite, di worship of money.

Money worship na di belief say to get more money go make me happier and solve all my problems. Dis script often dey found in pipo wit plenti of debt.

Di third na money as status symbol. DIs na di belief say your wealth equal your worth as pesin. If pesin ask you how much you earn, you brag about how much more you earn, you no buy somethin unless na new, you wan to show everyone how rich you be.

E dey usually happun to pipo wey come from low-income families.

And di fourth script na to dey hypervigilant wit money. Wit dis script I get nervous if I no get savings for emergencies.

Wia dis foto come from, Getty Images

How we fit overcome those beliefs say dey our mental constructs wey fit become negative patterns?

DI first tin na to identify wetin your financial script be. You fit ask yourself wetin be di three tins my mother or father teach me about money. Na about to dig little bit into our past.

Di second tin na to evaluate, to ask yourself if those beliefs dey help you in life or if dem dey hurt you.

And den, wen you sabi di beliefs wey dey hurt you, come di part to write dem down wit di aim to rewrite dat script. Rewrite those beliefs to make dem more accurate.

For example, if you think say all rich pipo dey stingy, and say dey hurt you, you fit consider how to turn dat belief into somethin more accurate, somethin wey dey less extreme.

You fit say, some rich pipo dey stingy and some rich pipo dey generous.

Di challenge na to make di belief less extreme, sake of say basically you wan dey rich and generous at di same time, at least dat na wetin I believe.

And dat new script wey you don rewrite don turn am into mantra and say: I fit be rich and I fit be good pesin. Or you fit say: di more money I get, di more pipo I fit help.

You do one mental reprogramming through repetition: you write am, you read am, and you say am out loud.

Source link https://www.bbc.com/pidgin/articles/cq5geq7nnqgo

Source: https://summacumlaude.site

Category: News