In the ever-evolving landscape of mobile technology, the Android operating system has emerged as a powerhouse driving both revenue and innovation across various sectors, particularly in finance and business. With its open-source nature and vast ecosystem of apps, Android has become an indispensable tool for businesses looking to leverage mobile technology to enhance their operations. This article delves into how Android generates revenue and fosters innovation within the finance and business sectors.

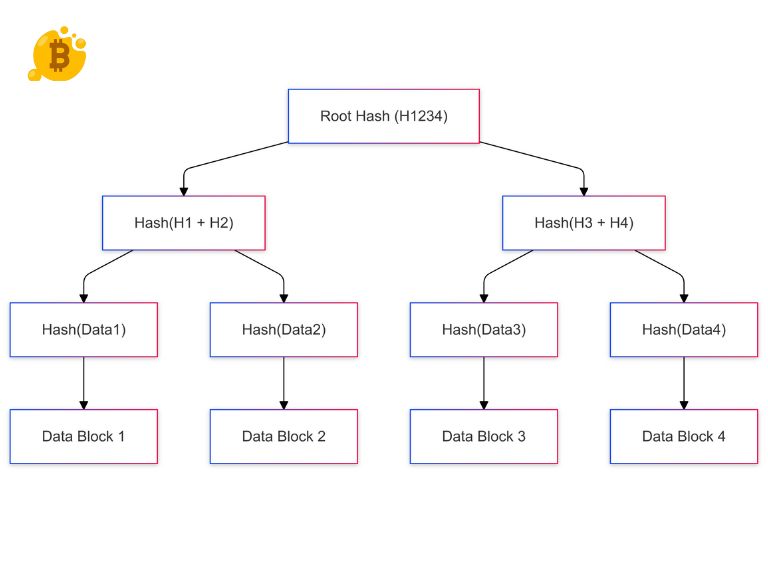

- What is Merkle Tree? Technical Architecture and Applications

- Understanding the Alternative Depreciation System (ADS): How It Impacts Your Business Taxes and Financial Planning

- Unlocking Growth: Investment Opportunities and Economic Power of BRIC Nations

- How to Calculate and Interpret Book Value of Equity Per Share (BVPS) for Smart Investment Decisions

- Understanding Assets Under Management (AUM): A Key Metric for Investment Success

Revenue Streams of Android

Google Play Store Revenue

The Google Play Store is a cornerstone of Android’s revenue generation. With over 2.8 million apps available, it serves as a central hub for users to download and engage with a wide array of applications. Google earns revenue through app downloads, in-app purchases, and by taking a 30% commission on developer revenues. This model not only incentivizes developers to create high-quality apps but also ensures that Google benefits significantly from the ecosystem’s growth.

You are viewing: How Android Operating System Drives Revenue and Innovation in the Finance and Business Sectors

Advertising Revenue

Android integrates Google AdMob, allowing developers to monetize their apps through advertising. Advertisers can customize their ads to reach specific audiences, leveraging the flexibility and targeting options provided by the platform. Google takes a percentage of the revenue generated from these ads, further contributing to its overall income.

In-App Purchases

In-app purchases are another significant revenue stream for Android. These include microtransactions for virtual goods or premium content within apps. This model allows developers to offer free or low-cost apps while generating substantial revenue through in-app sales.

Licensing Agreements

See more : How the Central Limit Theorem (CLT) Revolutionizes Finance, Business, and Investment Strategies

Licensing agreements play a crucial role in ensuring a consistent user experience across different devices. Manufacturers must adhere to certain standards and guidelines set by Google, which helps in maintaining the quality and security of the platform. These agreements also support the ongoing maintenance and development of Android.

Innovation in Financial Services with Android Enterprise

Secure and Managed Mobility

Android Enterprise offers robust security features that are essential for financial services. Features such as verified boot, device encryption, and a trusted execution environment (TEE) protect sensitive financial data from unauthorized access. Additionally, Google Play Protect provides multi-layered security by detecting and blocking malware threats, ensuring that financial data remains secure.

Flexible Device Management

Android Enterprise offers various device management options tailored to the needs of financial organizations. These include Bring Your Own Device (BYOD) policies, fully managed devices, and the use of Android Work Profile to separate work and personal data. The zero-touch enrollment feature allows for efficient device deployment without manual configuration, streamlining the process significantly.

Enhancing Employee Productivity

Android Enterprise enhances employee productivity through features like work profiles, AI-powered productivity tools, and digital wellbeing features such as Focus and Turn off work modes. Integration with Google productivity tools like Gmail, Google Drive, and Google Docs further enhances work efficiency by providing seamless access to necessary resources.

Meeting Regulatory Requirements

Financial organizations must comply with stringent regulatory requirements. Android Enterprise helps meet these demands through granular controls and secure data management. By providing a secure environment for handling sensitive information, Android Enterprise ensures that financial institutions can operate within legal frameworks while maintaining high standards of security.

Mobile Management Trends in Financial Services

Distributed Teams and Remote Work

See more : What is Market Sentiment? The Professional Guide to Market Psychology

The trend of flexible work arrangements is on the rise in financial services. Modern mobility solutions supported by Android enable distributed teams to work efficiently from anywhere. Simple, secure deployment and remote management of devices are crucial in this context, ensuring that employees can access necessary tools without compromising security.

Customer and Employee Digital Experiences

Mobile devices are transforming customer service in financial services. One-on-one mobile consultations and self-service kiosks are becoming more common, enhancing customer access to financial information. For employees, mobile devices provide real-time data, analytics, and research tools that improve their ability to serve clients effectively.

Balancing Productivity and Security

Balancing productivity with security is a critical challenge for financial organizations. The Android Work Profile helps achieve this balance by separating work data from personal data, ensuring that employees can remain productive while maintaining privacy and security.

Competitive Advantage through Mobility

Mobility innovation can provide a competitive advantage for financial organizations. By offering data, analytics, and research tools on mobile devices, these organizations can stay ahead in the market. This not only improves operational efficiency but also enhances customer satisfaction.

Case Studies and Real-World Applications

Financial organizations like IIFL Finance have successfully implemented Android Enterprise to enhance their operations. These implementations have helped these organizations stay compliant with regulatory requirements while securing client data effectively. For instance, IIFL Finance has seen improved security and efficiency in their mobile operations since adopting Android Enterprise solutions.

Source: https://summacumlaude.site

Category: Blog